- News Release

Recap: Black Friday & Cyber Monday 2023

As we reflect on the Black Friday and Cyber Monday weekend of 2023, we wanted to share some insights into the collective performance of wineries, including yours.

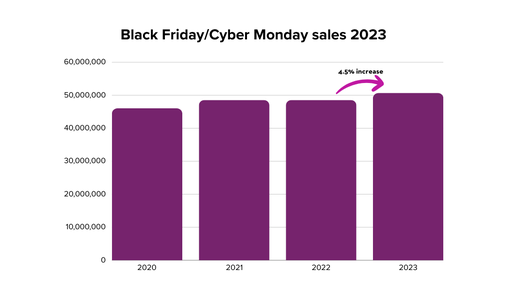

Sales performance

In a challenging global market marked by high inflation impacting consumer spending, wineries exhibited resilience and hard work, leading to some noteworthy results. Collectively, our WineDirect winery partners surpassed total Gross Merchandise Value (GMV) of $50 million. A standout moment was the Tuesday before Thanksgiving, with sales reaching a notable $8.5 million GMV in a single day.

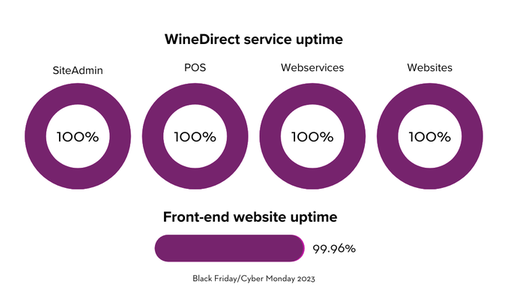

Platform performance

Performance and stability are crucial during such high-traffic periods and after working to address some issues related to recently deployed enhancements, we experienced a 100% uptime for the main applications throughout the five days, including 99.96%. for front-end websites.

Looking ahead to 2024

We're preparing for the next chapter as more wineries adopt the All-New WineDirect. As we actively continue to build out features for our purpose-built platform, we aim to provide a seamless experience for all wineries during Black Friday/Cyber Monday 2024. Our new platform will help wineries enhance their wine sales, encourage repeat business, and streamline day-to-day operations.

Update: EMV Issues Fixed

We are following up on the recent service interruptions and wanted to provide some updates. The WineDirect team has worked hard to implement a fix for the following issues:

- The issue causing some EMV/ POS card readers to freeze during processing has been resolved

- You can now use all EMV card readers, including the Vivopay 3300 and the Move 5000

- The issue with split tenders on POS has been resolved

We appreciate your patience and continued partnership. We encourage you to visit our Status Page for the most current updates. Our Client Success team is also at your disposal, ready to assist with any concerns or queries you might have. Please feel free to reach out through the 'Ask a question' feature in the admin panel or by emailing us directly at support@winedirect.com.

Wishing you all the best for a successful holiday season! 🍷

Recent WineDirect Classic Enhancements and Addressing Bugs

We wanted to provide you with an important update on the recent changes to our payment gateway, ensuring transparency and open communication every step of the way.

A step forward with upgrades

Last week, we successfully rolled out a significant upgrade to our payment gateway integration. Our primary goal was to rectify longstanding payment processing issues, such as transactions failing, remaining in a pending state, or returning ambiguous statuses. Additionally, we wanted to enhance the transaction speed in the tasting room, ensuring a seamless experience for all.

We are delighted to announce:

- POS transaction times have been significantly reduced by 50%, ensuring a smoother experience for your patrons.

- The issues responsible for pending transactions and incorrect statuses have been successfully rectified.

With the recent rollout, we encountered several payment issues that might have caused disruptions to your operations, and we sincerely apologize. Rest assured, we have successfully addressed all major issues related to this upgrade and are committed to delivering even smoother experiences with our future updates.

Currently, we are investigating two issues regarding EMV card readers. We are actively working on these issues and will provide updates as we have them on the Status Page.

Stay updated & engaged

While we do expect occasional, infrequent bugs, your feedback is invaluable to us in resolving them swiftly. If you encounter any payment issues or have questions, please use the 'Ask a question' feature in the admin panel's bottom right chat bubble. Alternatively, you can always email us at support@winedirect.com.

Thank you for your continued support and trust in WineDirect. We are here for you.

Failed Payment Transactions: More Information

On September 29th, beginning at approximately 1pm, users reported transactions declining intermittently with associated payment decline messages of "Connection Error" and "Server Temporarily unavailable." Our engineers identified the issue as a brief outage by USAePay, followed by periods of intermittent unavailability. If your winery was impacted by this, we hope that the information below will help with reconciliation by identifying failed orders.

To quickly identify any orders that may have been affected by the "Connection Error" decline, navigate to the Reports section. Under the Financial tab, select the Payment Gateway report. Upon reaching the report builder page, assign the date range 9/28 - today's date, 2021. Manage filters to ensure all Order Statuses are selected, and Manage Report Columns to ensure the Order Number, Payment Date and Payment Gateway Transaction ID columns are included. The Payment Gateway Transaction ID column will indicate any orders that had the "Connection Error" decline, making these easy to identify.

For any orders that a) were not successful in a secondary attempt, or b) had a refund that declined or c) that you wish to capture payment now, we strongly encourage you to compare against your iAccess portal to confirm a first attempt was not successful. If you have any point of sale orders that include a tip and were only authorized but not captured due to this error, please reach out to our payments team to assist you by capturing these amounts through the payments portal directly. If no tips were included, you may attempt to capture the payment through the payment tab on the order directly, after you've confirmed the payment has not already been captured (via iAccess).

Now: California Sales Tax Change for Marketplaces

You may have heard of a recent change to the California state statute for 3rd Party Marketers and wineries using their services. Essentially, the obligation to collect and remit sales tax for sales to consumers using 3rd Party Marketers will now shift from the winery “seller” to the marketplace. This means our marketplace partners will start remitting California sales tax for orders originating from their platform. Vivino will be starting that remittance effective May 1st, so we are outlining a couple of simple steps for orders to ensure tax collection continues to run smoothly

Tax Disbursement

As part of our monthly disbursement process, WineDirect will be disbursing the sales tax amounts to our partners (ie. Vivino) and no longer passing those onto the winery, specifically only for California destination orders. You will see this in the form of a debit as a part of your statements, so that the tax amount is deducted from our total disbursement amount.

Tax Reporting with ShipCompliant Integration

Since our partners will remit California taxes on sales to consumers made through their platforms, you will need to ensure that these California destination orders are not included within your California reports.

For wineries integrated with ShipCompliant this will require changing the status of the orders in ShipCompliant, from ‘Shipped’ to ‘In Process’, and the removal of the tracking number on those same orders. We have confirmed this with ShipCompliant's support as the best way to exclude those orders from your tax forms. This can be done either one by one in the ShipCompliant portal, or in bulk. The bulk option is by downloading the orders in ShipCompliant, changing their status & removing tracking numbers, and then reuploading the file. This update would need to occur the first of the month to effect prior month.

We will be working to automate this step, so you will not have to take these actions in the future. We will keep everyone updated once timing for this automation has been determined.

Tax Reporting for those WITHOUT ShipCompliant Integration

Since our partners will remit California taxes on sales to consumers made through their platforms, you will need to ensure that these California destination orders are not included within your California reports.

For wineries that use one of the reports or obtain the data via an integration for your compliance filing, your compliance expert will have all the data that they need to determine how to deal with those orders. While not exclusive, some possibilities are simply to delete the California orders, or bulk upload all the orders and then modify California orders so they do not count towards the tax calculation. This process would need to be completed by the first of each month to effect prior month.

We would recommend that you talk to your compliance expert prior to taking any action in order to cover additional details that may be required.

Bug Fix: Email Address Required on POS for Event Ticket Purchasers

We are now requiring an email address for receipt orders placed on the POS that contain event tickets.

We have eliminated a bug that previously caused customers who purchased event tickets in your tasting room from not recieving an email confirmation with their PDF ticket.

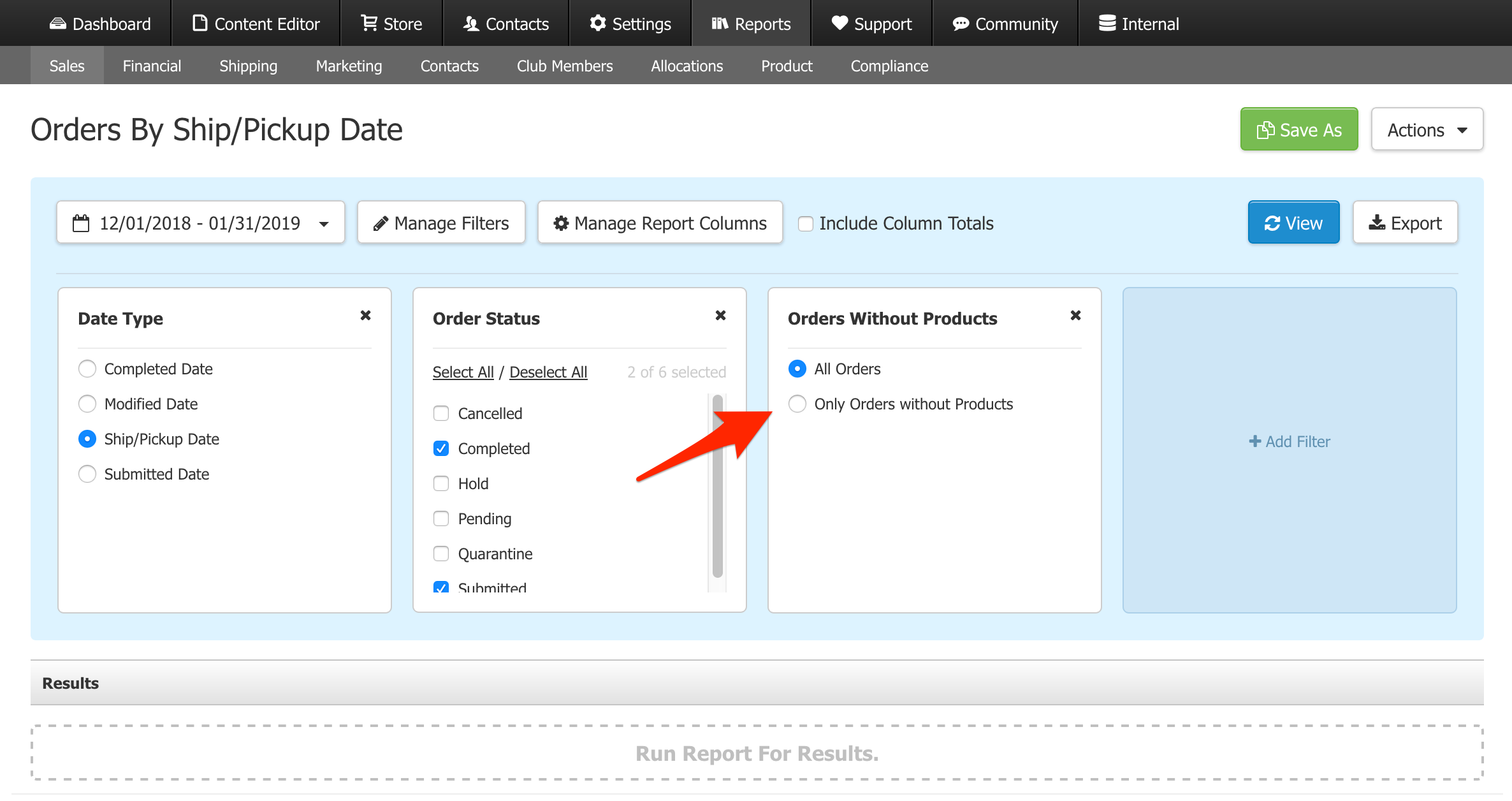

New Reporting Filter in Orders by Ship/Pickup Date

We have added a new filter to the Orders by Ship/Pickup Date report called Orders Without Products. This filter designed to address a limitation on our Order Detail Report.

In the Order Detail Report, orders contaning no products will not populate any values and will always display $0. This is because Order Detail Report is an product-based report and since these orders contain no products, it cannot calculate a value to display. Common scenarios which creates orders without products are refunds where only the shipping fee is refunded (Shipping Only Refunds) or when using the Pickup to ShipX feature.

To find these values that are left off the report, we would recommend using the new Orders without Products filter. This filter will help you identify orders with no SKUs and you can use these values to fill in the missing values in Order Detail Report.

New: Order Detail Report BETA

At the core of this enhancement, we want to improve the way our reports handle discount transactions in the Order Detail Report.

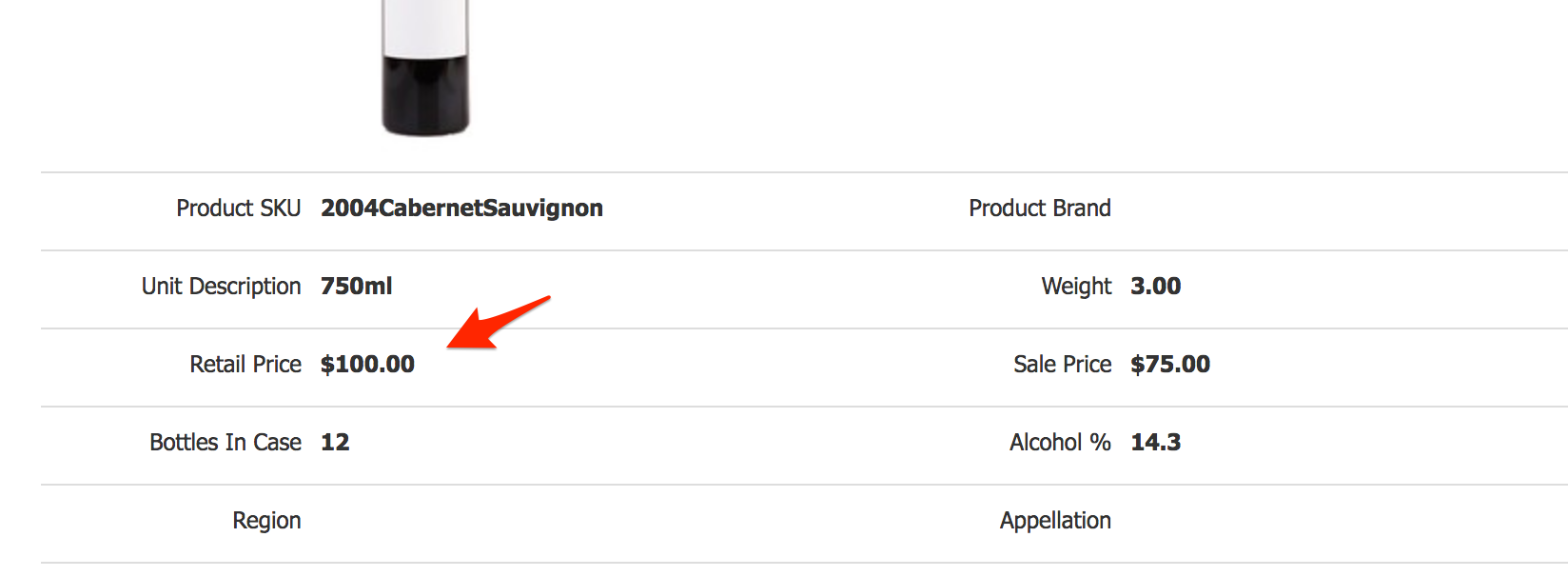

There are 4 ways a price of a product can be reduced from the original Retail Price.

- In the Product page, there is a field for Retail Price and Sale Price. The difference between the two values is a type of price reduction.

- There is a way to set a Price Level to your product. There will be a difference between the Price Level price and the Retail Price.

- You can override the price of a product manually. The difference between the starting price and the overriden price is another way to reduce price (Price Override).

- Lastly, you can set up promotions under Store > Promos. You can set up discounts to apply under certain conditions and another type of price reduction (Promotions).

To report on these different price reductions more accurately, we have added 3 new columns. Here are the columns we added and how it's designed to display the data:

- Price Adjustment = Product Retail Price - Sale Price or Price Level price.

Summary: The difference between Retail Price and Sale Price on the Product page at the time of the transaction. If you are using Price Level, then it is the difference between the Retail Price and the Price Level price.

- Ext Price Adjustment = Qty x Price Adjustment

Summary: Sum this column for the total difference between the Retail Price and the Sale Price.

- Ext Item Discount = Qty x Item Discount

Summary: Sum this column for the total discount provided through Promotions and Price Override.

Daily Activity Report BETA

We only made one change in Daily Activity Report BETA. The Gross Sales field on the Daily Activity Report has been adjusted. Previously, it would calculate its value by looking at Qty x Original Item Price. We have adjusted this so it would calculate using Qty x Retail Price, which will provide a more accurate representation of Gross Sales.

There are differences between Retail Price and Original Item Price. The Original Item Price refers to the price of a SKU when it is pulled into an order. The Retail Price column refers to the value stored in the Retail Price field of the Product page at the time of the transaction. This difference manifests most commonly for Product that has a Retail Price and a Sale Price value in the Product page. In this scenario, the Original Item Price will be the Sale Price, but the BETA which uses Retail Price will only refer to Retail Price.

New Columns in Order Detail Report

We have added two new columns in the Order Detail report to help provide more granular reporting on Product Pricing. In the Order Detail Report, we added two columns: Retail Price (Column CY) and Ext Retail Price (Column CZ).

- Retail Price column will display the Retail Price of the product at the time of transaction.

- Ext Retail Price will display Retail Price x Quantity Sold.

Hope this helps!

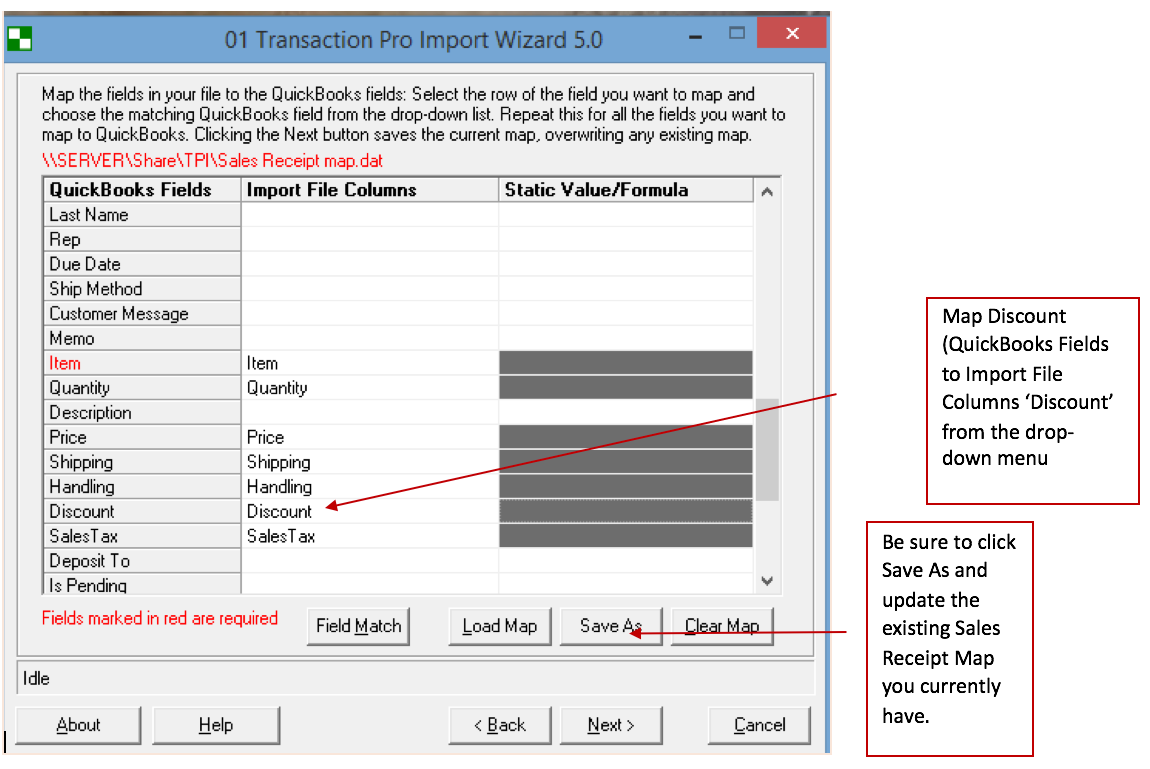

Bug Fix: Changes to Discount Columns in Quickbooks V2 Report

In order to facilitate Quickbooks reporting via Transaction Pro Importer, we have made two changes to the columns included in our Quickbooks V2 Report:

-

Column AO has been renamed Item Discount (instead of Discount) and provides the discount amount PER ITEM.

- We have added a new column (Column BB) titled Discount. This column provides the TOTAL discount applied across the entire order.

This change enables you to report on your discounts in Quickbooks using Transaction Pro Importer.

If you are using Transaction Pro Importer to upload data into Quickbooks, we recommend you adjust your mapping settings to take advantage of this bug fix.

Here is a sample mapping we recommend:

Please note this bug fix applies to WineDirect's New Reports ONLY. Our old reports have not changed.