Cookie consent

By entering and using this site, you consent to the use of only necessary cookies to enhance your site experience and improve our services.

%20(3).png)

Stay informed about ongoing developments and gain insights into bug fixes and exciting feature releases within WineDirect Classic.

“Great onboarding support and a huge library of online documentation and training videos"

Eric Cavatore

Crossing Vineyards & Winery

%20(2).png)

%20(1).png)

From our enriching academy and insightful blogs to in-depth guides and on-demand training videos, we've curated a wealth of resources to empower your wine-selling journey.

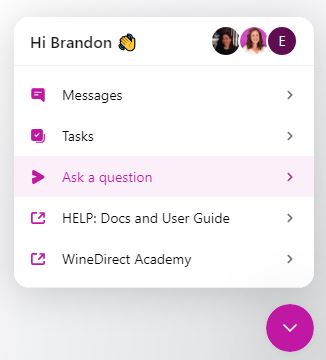

Log in to WineDirect, then find and click on the wineglass icon at the bottom right. Once open, select the 'Ask a question' tab.