- Store

- State Profile

State Profile (for US and Canadian Clients)

The State Profile section of the admin panel (Store > State Profile) allows you to setup your basic compliance and tax settings for each state or province. You will be able assign tax rates to both wine and non-wines products, as well as adding state handling fees or taxable shipping charges. You also have the ability to add special shipping or compliance messaging on per state/province basis.

The following video and text support will assist you in setting up your state profile.

Wines Section: Learn about editing compliance/tax settings for wine. Learn More >

Product Section: Learn about editing compliance/tax settings for non-wine products. Learn More >

Spirits: Learn about editing compliance/tax settings for Spirits. Learn More >

Shipping Advisory: Learn about setting shipping advisorys. Learn More >

Compliance Advisory: Learn about setting compliance advisorys. Learn More >

Custom Taxes: Learn how to add Custom Taxes to your website Learn More >

Compliance Advisory: Learn about setting compliance advisorys. Learn More >

State Profile FAQs: Frequently asked questions about the state profile and taxes. Learn More >

Video Keypoints:

- 00:00 Introduction and accessing State Profile

- 02:39 Product Bundles use Product Tax Rate

- 03:25 Shipping Advisory Management

- 04:38 Compliance Advisory Management

- 05:50 Example of Advisory Messages online

Please Note:

If you use an integrated compliance provider [like ShipCompliant], the tax rates in your state profile are overridden if you use their Tax by Zip Code option. We still recommend that you populate the state profile taxes as a backup tax rate for the state if the zipcode lookup does not successfully pull a tax rate.

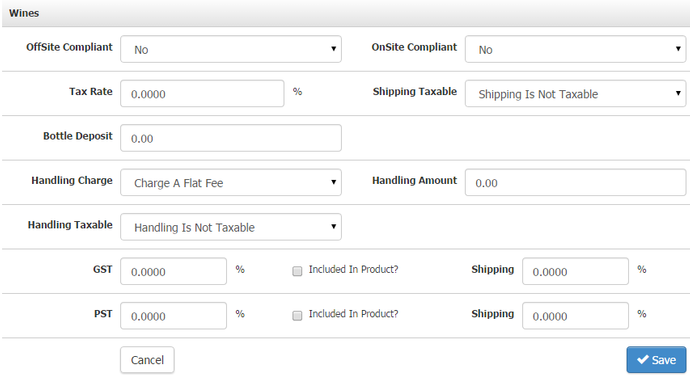

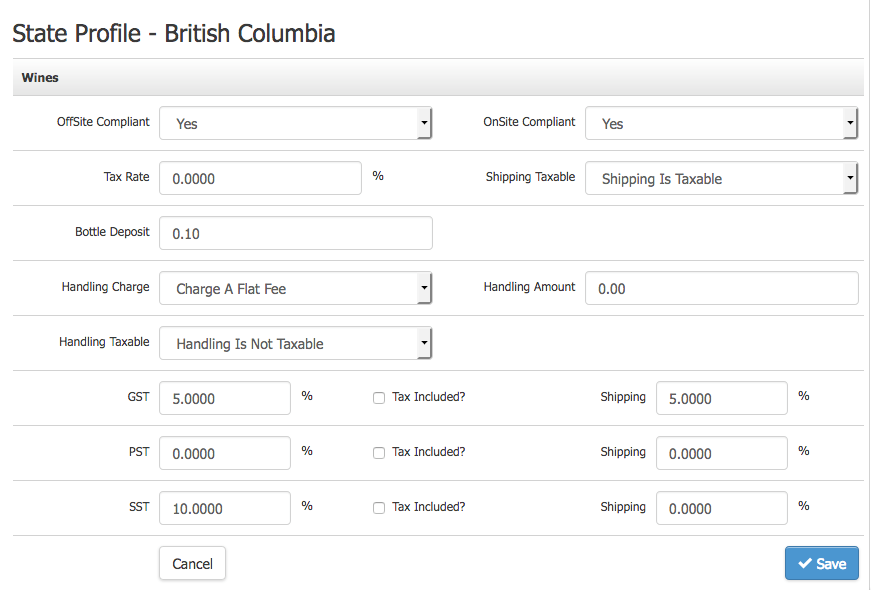

Wines Section

The Wines section is where you will modify your compliance and tax settings per state/province. There are a number of different selects to help you manage compliance and taxes.

1. To edit a State or Province, please click on the name of the State.

2. Click on Edit.

3. Once you have fill out the form in the Wines section, please click Save.

Table of Definitions

| State | The current state/province selected. |

|---|---|

| Compliant | Yes or No. States/Marked will allow customers to purchase and ship wines to their state/province. |

| Tax Rate | This is where you will enter a single percentage based tax rate for the entire state/province. |

| Shipping | Shipping Is Taxable or Shipping Is Not Taxable. |

| Handling | Handling fees are either Charge A Flat Fee or Charge A Percentage. |

| Amount | Enter the amount in dollars or percentage for the handling fee. |

| Taxable | If handling fee is taxable or not taxable. |

| *Offsite Compliant | Select Yes or No if compliant for offsite orders (Orders placed on the website). |

| *Onsite Compliant | Select Yes or No if compliant for picking up onsite orders (Orders placed through WineDirect POS). |

| Bottle Deposit |

The amount in $ for bottle deposit. This feature needs to be turned on by WineDirect Support. Please contact us if you do not see this feature and require it for your sales. Note that promotions do not apply to bottle deposits. |

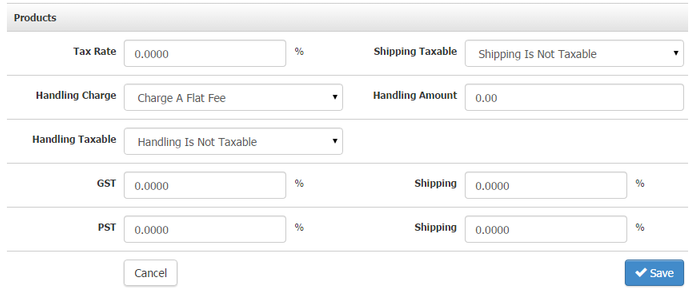

Product Section

This section is for product type other than wine or spirits. For example, T-Shirts, Corkscrew, etc.

1. Simply fill out the form exactly like the Wines section by first clicking on Edit.

2. Remember to click Save.

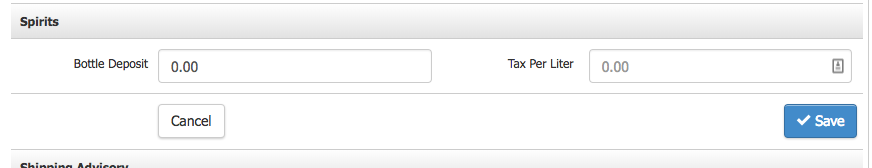

Spirits

This section is for configuring Bottle Deposit and Sales Tax for Spirits products.

1. Click on Edit.

2. Set up Bottle Deposit and Tax Per Liter.

3. Remember to click Save.

| Bottle Deposit | The amount to charge for Bottle Deposit fee per bottle. |

|---|---|

| Tax Per Liter | The amount to charge for Sales Tax per Liter. |

Compliance

Compliance applies to you wines, wine products and product bundles containing wine. Products, event tickets, gift cards, and other non-wine products are not checked for compliance. The WineDirect platform has a basic Yes or No compliance setting per state or province. This means that states/provinces marked as Yes will allow wines to be sold to customers shipping their wine to these states/provinces.

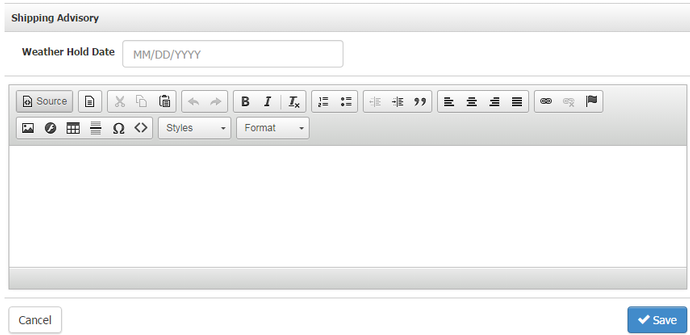

Shipping Advisory

The shipping advisory message will appear in the cart and checkout area. It can also be used to inform customers that wines will be held during hot/humid weather as it could spoil the wine and be shipped at later date when the weather is more forgiving.

1. To have a weather hold date appear in the cart and check out, simply enter the date in the Weather Hold Date in the format of MM/DD/YYYY.

2. To enter a message, simply click on the textbox, type in your message and click Save.

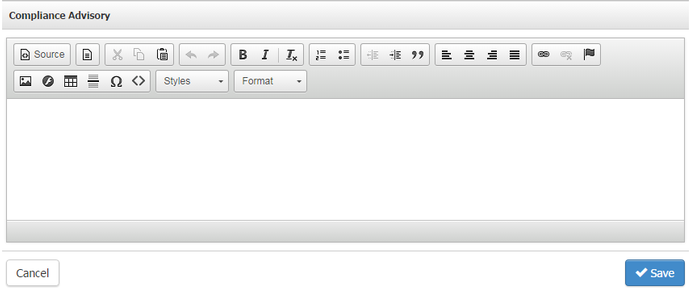

Compliance Advisory

The compliance advisory message will appear on the product list and product drilldown pages. This section is to inform your customers of any compliance issues regarding the selected state.

To enter a message, simply click on the textbox, type in your message and click Apply Changes.

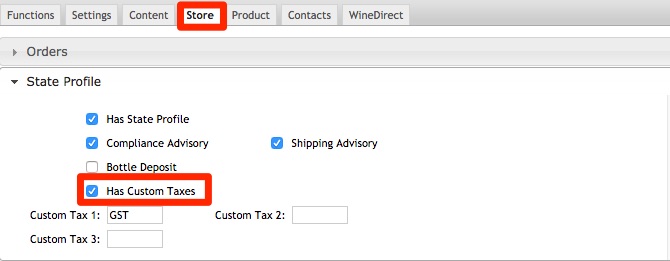

Custom Taxes

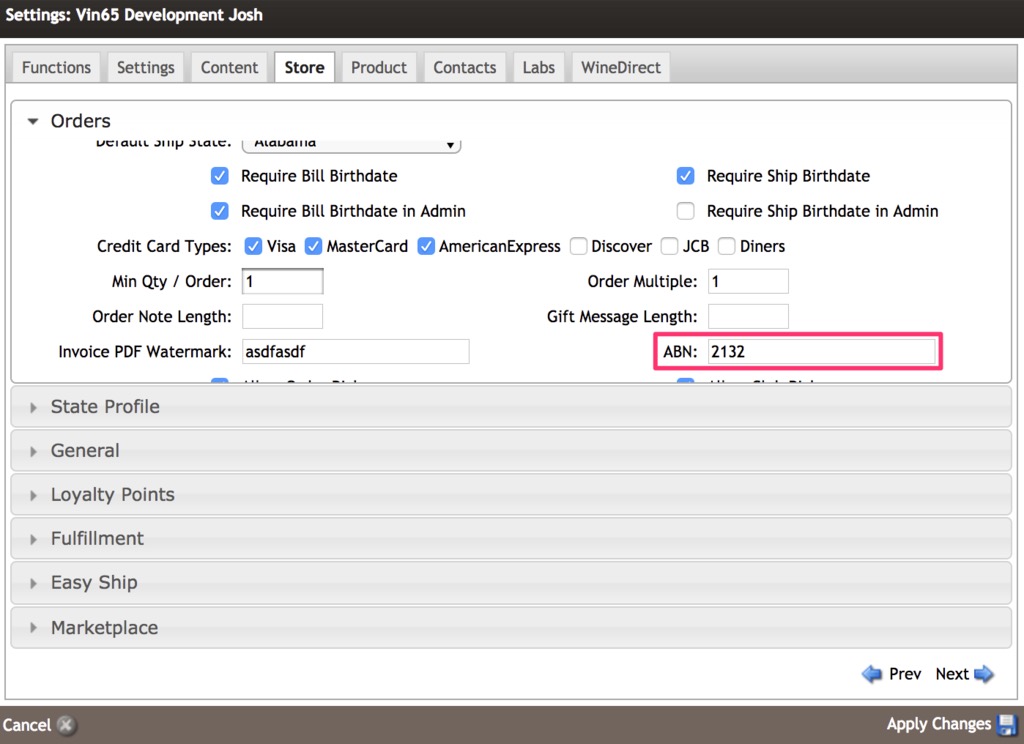

You can add up to 3 custom taxes on your website (ie. GST/HST/PST for Canadian clients or GST/ABN Number for Australian clients)

To add Custom Taxes, go to Settings > Website Settings > Store > State Profile > Has Custom Taxes. Add the Custom Tax names accordingly.

Go to Store > State Profile > Pick a State/Province > Add the Tax Rates. You can have the tax included in the Product price by enabling Tax Included?

For Australian wineries, you can also set up an ABN number and have the number display on POS receipts. To do so, go to Settings > Website Settings > Store > ABN.

State Profile FAQs

- Are bottle deposits charged on wine products?

- Should I use the GST/PST/HST boxes or the Tax Rate box when determining taxes?

- Am I able to set a different compliance status for a specific product, independent of my state profile?

- Is there messaging for the West Virginia alcohol warning on order confirmation emails?

Are bottle deposits charged on Wine Products?

No, Wine Products will not be charged the bottle deposit that you have set up within your state profile.

Should I use the GST/PST/HST boxes or the Tax Rate box when determining taxes?

You should be using only the PST/GST/HST boxes or the Tax Rate box, but not the both of them in conjunction.

Am I able to set a different compliance status for a specific product, independent of my state profile?

You can do so by enabling Override State Profile with a Product's Manage Properties page. The specific states can be set from the Manage Compliance tab that will appear after Override State Profile is enabled.

Is there messaging for the West Virginia alcohol warning on order confirmation emails?

Yes. Order confirmation emails going to shipping addresses in the state of West Virginia or confirmation emails to a West Virginia pickup location address will contain the following warning message automatically:

As required by West Virginia law, customers may access important information about the effects of alcohol by following the links below from the West Virginia Alcoholic Beverage Control Commission:

Fetal Alcohol Syndrome | Blood AlcoholThis information will only appear in order confirmation emails containing the //OrderBlob// auto-populating data tag. This messaging is system generated and cannot be edited or removed.