- More ›

- 3D Secure (3DS) 2.0

3D Secure (3DS) 2.0

Part of the WineDirect Payments offerings, 3D Secure or 3DS is a discrete fraud prevention tool created by the major credit card networks (Visa, Mastercard, etc.) to combat online fraud.

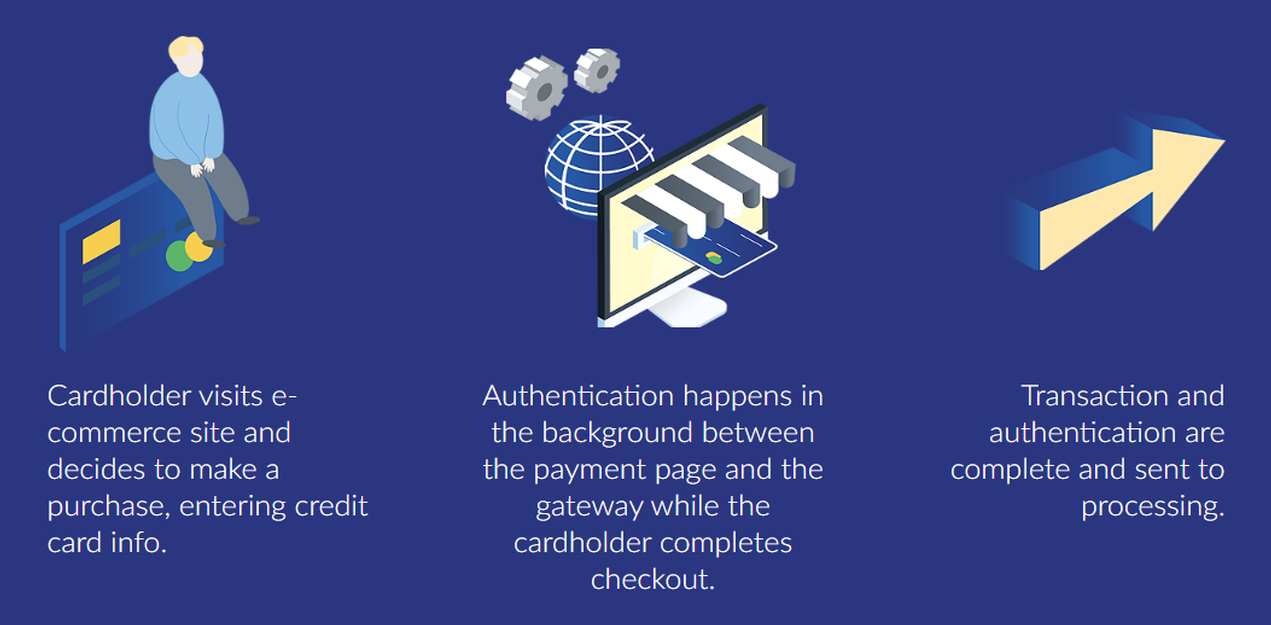

It provides an additional layer of security on the latest WineDirect checkout for online credit card and debit card transactions. Transactions authenticate silently in the background with absolutely no lag or no impact on the customer checkout experience.

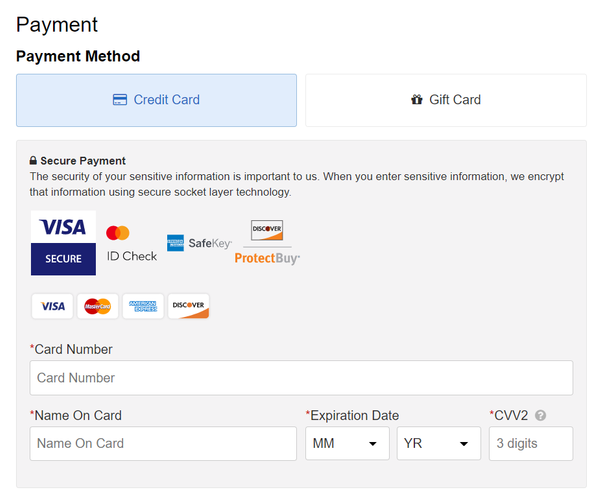

For websites with 3DS activated, card brand badges for the Visa Secure and Mastercard Identity Check fraud-prevention programs will display to help build cardholder awareness and assurance that 3DS is part of the overall checkout process.

Key Benefits of 3DS:

- No false declines - all transactions go through as normal

- No customer impact - frictionless network level chargeback protection for authenticated transactions

- No disputes - chargeback transactions that were authenticated will not hit your merchant account

Eligibility Requirements

- Located in the US or Canada

- Current customer with WineDirect Payments

- Checkout V2.0 is enabled

Here's how it works:

How Do I Sign Up?

Non-WineDirect Payments Customers

You need to be an active client on the WineDirect Payments platform to be eligible for 3DS to be activated on your website cart.

Click here to request a demo and get the latest fraud solutions and fraud prevention tools.

Wineries with Legacy Checkout

If you are already on the WineDirect Payments platform but are still using the legacy checkout, you will need to first upgrade to our current checkout tools. Once that’s published, contact support@winedirectpayments.com who will then enable 3DS on your website.

WineDirect Payments Customers with the Latest Checkout

Current WineDirect Payments customers do not need to take any action for 3DS to be enabled. Starting on the release date, 3DS protection will be enabled on their website over a 2-4 week period.

If you sign up for WineDirect Payments after that transition period, 3DS will enabled for you automatically as part of the initial onboarding process.

3DS FAQ

- Will 3DS ever block payments?

- What percentage of transactions are authenticated?

- How will I know if a transaction is authenticated?

- What happens if my transaction doesn’t get authenticated?

- When the liability shift does occur, and there is a chargeback, what happens?

- Does 3DS protect tasting room or POS transactions?

- Does 3DS protection cost extra?

Will 3D Secure ever block payments?

No, it's frictionless and transactions will never be prevented from going out. 3DS uses risk based authentication to ensure chargeback mitigation without friction or false declines. The processing bank though is always responsible for approval or denial of an authorization request.

What percentage of transactions are authenticated?

Currently, about 65-75% of website transactions are authenticated and qualify for a liability shift. As participation by issuing banks increases, that rate will increase.

The 3DS merchant account provided by WineDirect Payments will provide an overall authentication percentage across all transactions and at the individual transaction level will indicate if it is protected by 3DS.

How will I know if a transaction is authenticated?

Reporting on whether 3DS is working at a transaction level is available in your USAePay portal. In the transaction details you will see the Verified By Visa® Authentication and if it was authenticated, the “Validated” field will indicate the CAVV (Cardholder Authentication Verification Value) attempt passed validation.

The above applies to all card brands, not just Visa. 3D Secure encompasses both Visa and Mastercard's security programs, as well as programs offered by JCB and American Express.

What happens if a transaction doesn’t get authenticated?

If the transaction is not authenticated, the 3DS software will close out the authentication request and the transaction will continue as normal. There will be no impact on the customer experience, however the liability shift will not occur.

When the liability shift does occur, and there is a chargeback, what happens?

As a merchant, you will not know when a chargeback occurs. There’s no dispute, and it doesn’t impact your ratios. Instead of going back to the merchant, the issuing bank will refund the customer on their credit card or they will send it to the fraud department for further investigation.

Does 3DS protect tasting room or POS transactions?

No. 3DS is designed as a fraud prevention feature that only applies to online transactions made on your online store, not other sales channels like the tasting room using the POS.

Does 3DS cost extra?

No, this is an included benefit for customers of WineDirect Payments as part of an ongoing effort to offer the latest fraud prevention technology to protect wineries and their customers.